Module 1: The Core Mechanism — Concentrated Liquidity

At the heart of Uniswap V3 lies "Concentrated Liquidity," a fundamental shift in how capital is utilized within an Automated Market Maker (AMM).

1. The Problem with V2: The "Lazy Capital" Problem

To understand V3, we must first identify the inefficiency of Uniswap V2.

- The Scenario: Consider a stablecoin pair like DAI/USDC. The goal of an LP is to provide liquidity within a stable range, typically between $0.99 and $1.01.

- The V2 Flaw: To maintain price stability while handling swaps, V2 spreads your liquidity across a price curve that goes from zero to infinity (0 to ∞).

- The Example: If you have 200 DAI + 200 USDC (totaling $400) in a V2 pool, swapping just a few tokens can push the price significantly because your capital is spread so thin.

- The Waste: Most of those 400 tokens are "lazy." They sit in the pool to support prices that will likely never be reached (like DAI hitting $100 or $0.01), doing nothing to earn fees for the majority of trades.

2. The V3 Solution: Concentration

Uniswap V3 changes the game by allowing LPs to "pick their battles."

- The Shift: Instead of spreading liquidity across all possible prices, you define a Price Range (e.g., $0.99 to $1.01).

- The Impact: Your capital is now concentrated exclusively in that active zone.

- The Result: Your concentrated position can now earn fees comparable to a much larger pool. For example, a $183,500 V3 position can outperform a $1,000,000 V2 position in terms of yield.

3. The Vocabulary: Virtual Reserves

To implement this, V3 introduces two critical concepts:

- Real Reserves (x, y): This is the actual capital you hold and deposit (e.g., $183,500).

- Virtual Reserves (L): This represents the "Mathematical Depth." To keep the price curve flat and stable within your range, the AMM calculates swaps as if it had the depth of a much larger pool (e.g., the $1,000,000 equivalent).

The Formula:

Real Reserves + Virtual Offset = Virtual Reserves

4. The Efficiency Calculation

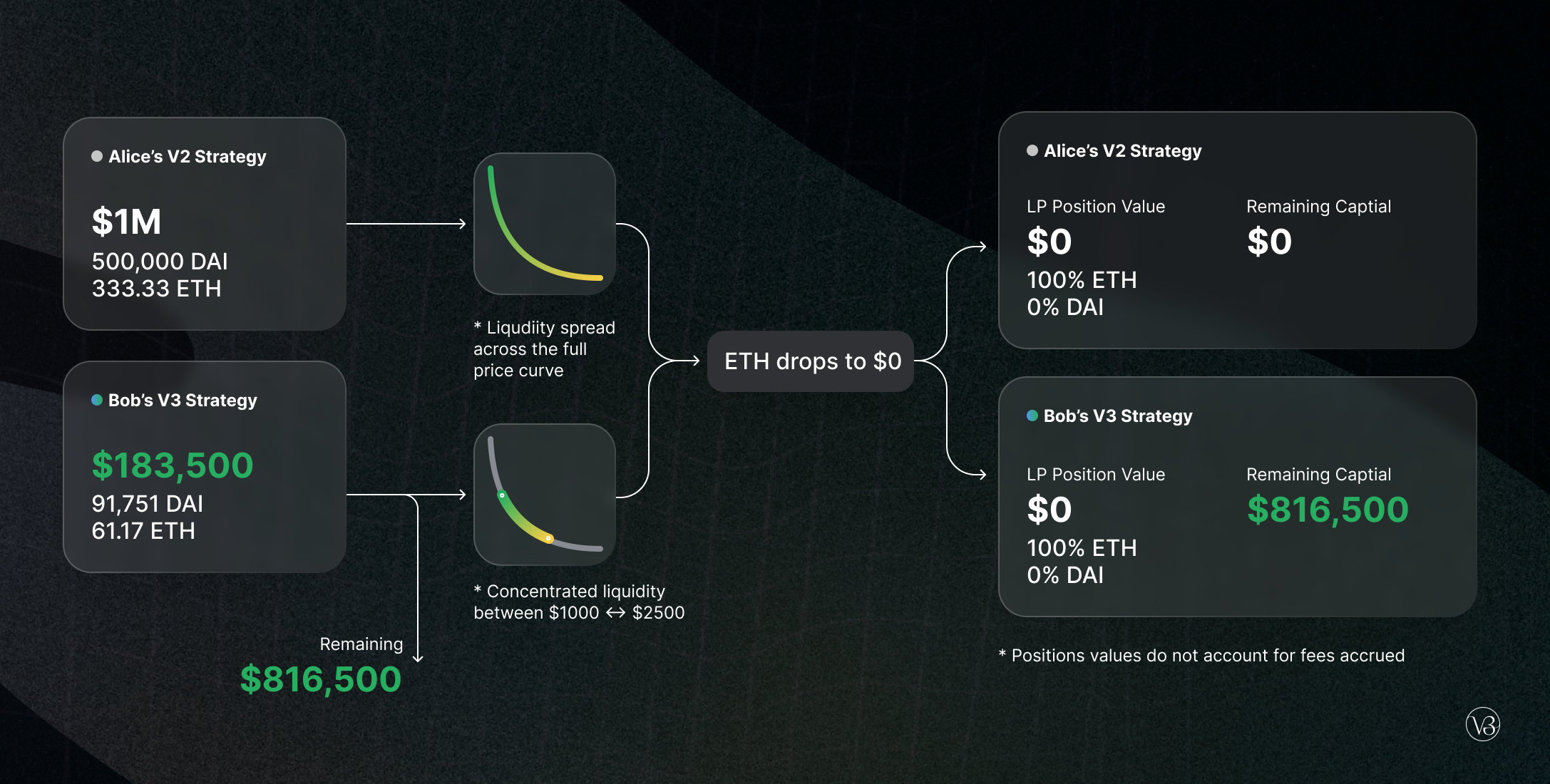

Now let's move beyond stablecoins to see how concentrated liquidity truly shines with volatile pairs. The power of this mechanism is best shown through its capital efficiency. Consider a DAI/ETH pool where two LPs want to provide liquidity for ETH prices between $1,000 and $2,500:

- Alice's V2 Strategy: $1,000,000 (500,000 DAI + 333.33 ETH), spread across the entire price curve → 50% APR.

- Bob's V3 Strategy: $183,500 (91,751 DAI + 61.17 ETH), concentrated in the $1,000–$2,500 range → 314% APR.

- The Advantage: Bob earns over 6x higher APR while using less than 1/5th of the capital.

By concentrating liquidity, the capital becomes significantly more powerful—earning fees as if it were a much larger "whale" position while maintaining only a fraction of the actual exposure.

Limited Exposure & Range Protection

Concentrated liquidity also reduces the amount of capital at risk. Using the same DAI/ETH example above—if ETH drops to $0:

- Alice (V2): Her entire $1M position becomes 100% ETH, 0% DAI—fully exposed to the crash.

- Bob (V3): His position only became 100% ETH when the price exited his $1,000–$2,500 range. He retains $816,500 of his capital outside the pool, protected from further loss.

5. Range Orders

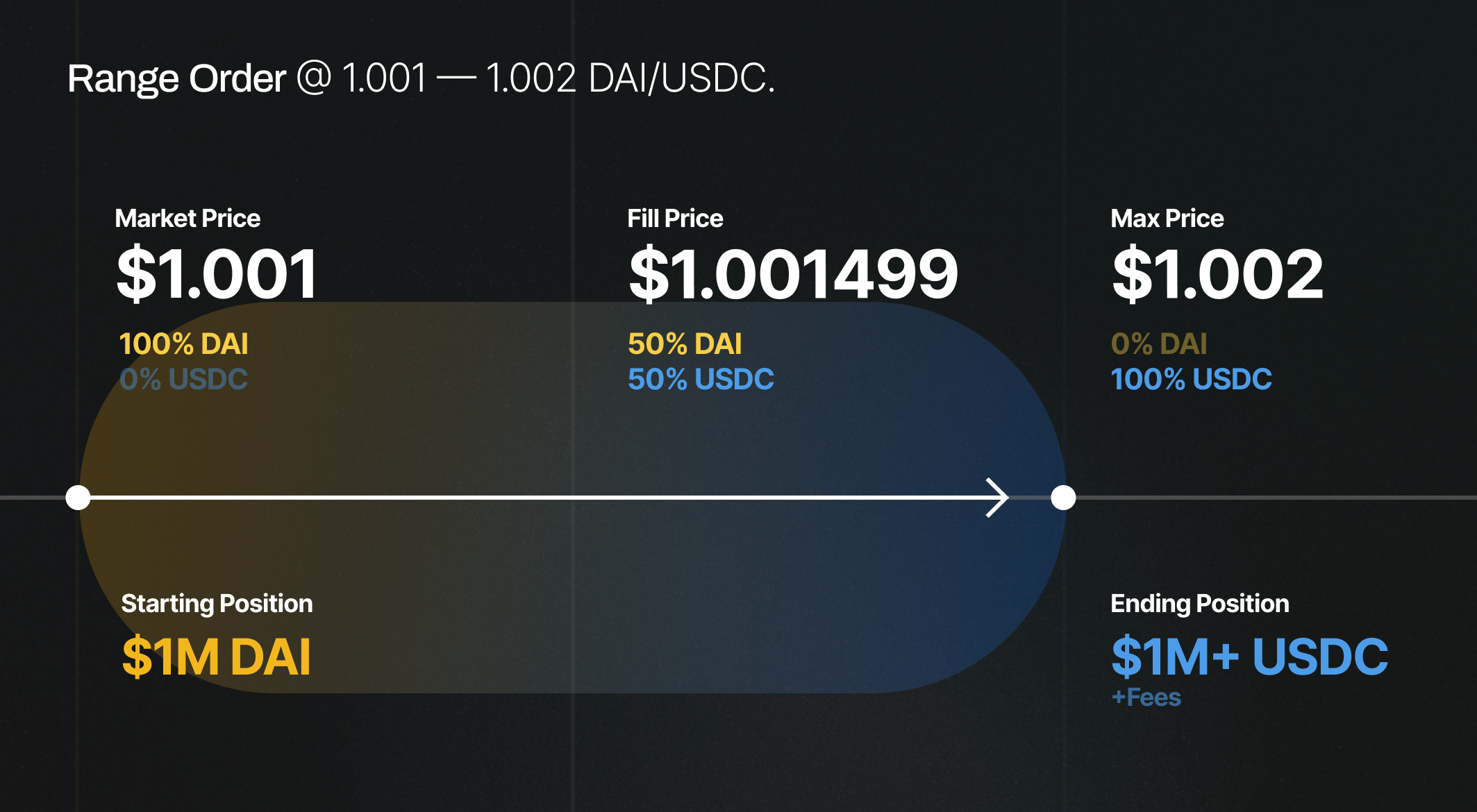

A unique feature of concentrated liquidity is the ability to create "Range Orders." By providing liquidity in a very narrow range that is entirely above or below the current price, LPs can effectively create a limit order that executes along a smooth curve.

This allows for more sophisticated trading strategies, such as profit-taking or buying into a position at a specific price range, while earning swap fees until the order is fully executed.

Key Takeaways

- Capital Efficiency: Concentrated liquidity lets you earn fees as if you had 5–10x more capital by focusing on active price ranges.

- Reduced Risk: Your exposure is limited to your chosen range—capital outside that range stays protected.

- Strategic Flexibility: Range orders enable limit-order-like functionality while still earning swap fees.

In the next module, we'll dive deeper into how ticks and price ranges work under the hood, giving you the tools to optimize your liquidity positions like a pro.